Decentralized Finance: Alternatives and Challenges in 2023.

Summary: The decentralized finance (De.Fi.) know-how.

Classical finance is a closed, institutionally ruled, intermediated system; DeFi, decentralized finance, is an open system, ruled by customers and buyers themselves, subsequently disintermediated, quick and low cost, however presently unregulated and so represents a high-risk profile exercise. The acronym DeFi actually means Decentralized Finance, decentralized finance, and is an evolution of the crypto world utilized to monetary providers. Digital cash and cryptocurrencies, equivalent to Bitcoin created in January 2009 and since then all of the 1000’s of different cryptocurrencies which have adopted it’s basically programmable cash designed to function on a decentralized digital community.

A decentralized digital community is extraordinarily ubiquitous and resilient, because it provides no disaster level: ought to a number of nodes go down, the surviving nodes can redirect the connection by way of the community, using different nodes on-line. Whereas related to the community, every node can talk with different nodes utilizing a particular protocol, which permits transactions or different forms of digital contracts, and thus additionally monetary providers, to be made and validated.

The principle monetary providers which were disintermediated with DeFi are at first Lending, Borrowing, Buying and selling, Derivatives, Asset administration and Insurance coverage. And the volumes of worth travelling and being exchanged by way of decentralized finance providers are already huge: final 12 months, greater than $200 billion was exceeded.

1. The Decentralized Finance (De.Fi.) vs Centralized Finance (Ce.Fi).

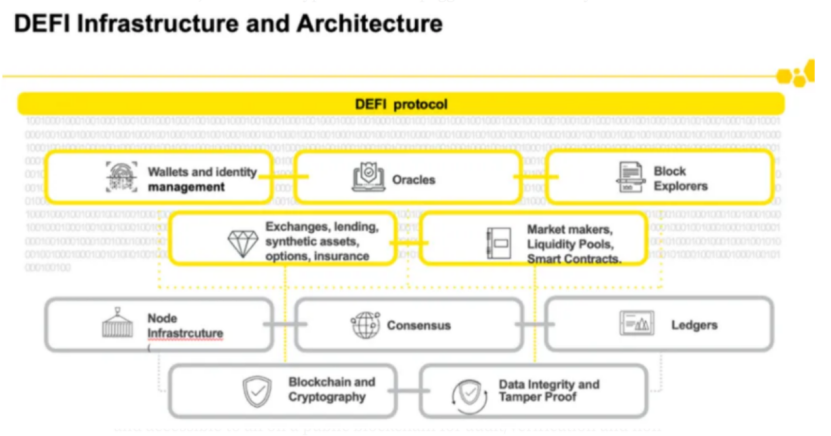

Decentralized Finance (DeFi) or “open finance” is the automation of the monetary trade sector based mostly on exponential blockchain applied sciences, eradicating counterparties and shifting threat to know-how. The DeFi neighborhood is predicated on blockchain (digital ledger) specializing in ideas of information integrity, digital identification, neighborhood consensus, mutuality, democratization, belief in information sharing and an immutable single model of the reality. Many functions or protocols exist and interoperability between them is paramount for mainstream adoption to extend demand in worth of interchange of digital belongings referred to as the “INTERNET of VALUE” (IOV). Funding markets are being digitized utilizing Computerized Market Maker (AMM) software program utilizing cryptocurrency and automation of banking features utilizing Digital Exchanges (DEX). In parallel Central Financial institution Digital Currencies (CBDCs) are being created by governments. DeFi and CBDCs are DeFining the “Way forward for Cash” bringing extra market belief and transparency. Whether or not you’re buyer, supplier or regulator the holy grail quest is similar specifically asset lessons with a better charge of return and seek for extra yield inside a correct threat framework. DeFi, which incorporates the Non Fungible Tokens (NFT) growth, is a supply of those new asset lessons. Utilizing a course of referred to as yield farming, buyers and lenders lock up cryptocurrency tokens in change for buying and selling charges to get larger returns at larger threat.

Volatility and market fluctuations in Cryptocurrencies are obstacles to entry. Stablecoins, that are Cryptocurrencies pegged to fiat foreign money or different bodily belongings, deal with this volatility problem and likewise kind the idea of the event of CBDCs, which might be on a collision course with DeFi in some jurisdictions reasonably than being complimentary. Regardless of the future, from cryptocurrency, lending and borrowing, prediction markets, funds, insurance coverage and NFT marketplaces, the DeFi panorama now represents an expansive community of protocols, IP and monetary devices value a minimum of $100 billion USD. DeFi pertains to a shift from centralized monetary techniques to peer-to-peer finance and fuelled by the pandemic digitisation acceleration. The features of DEX, AMM, lending/borrowing platforms and Stablecoins, have to be understood within the context of yield era throughout the realm of threat administration. Custody of tokens strikes to private wallets and safety to good contract know-how with much less want for repetitive Know Your Buyer (KYC) as every little thing is totally audited on the blockchain. Options shared by protocols are open supply, transparency, interoperable and composable (programmable by plug factors), and permissionless. So open and accessible to all on a public blockchain for audit/verification and non-custodial, which implies customers management of their wallets and likewise their very own legal responsibility. All transactions are seen by way of blockchain explorer functions so reconciliation and clearing could be finished in actual time. Curiosity is calculated, paid and compounded repeatedly. As new markets are made and digital belongings created there needs to be liquidity the place yield could be farmed.

Depositors who make investments crypto belongings into the pool mechanically obtain a liquidity supplier token (LP) indicating their share of the pool. Creating liquidity, the place anybody with funds generally is a market maker, comes with a threat that the worth of tokens deposited can drop and trigger lack of worth. This threat is mitigated by collateralized Stablecoins which peg again volatility within the buying and selling swimming pools. Collateralization is vital to constructing out an insurance coverage reserving infrastructure. Decentralized liquidity swimming pools are a key innovation in DeFi as they maximize effectivity and decrease prices whereas sustaining an open-source single model of the reality with blockchain safety and immutability. DeFi has its personal metric to measure profitability, the Complete Worth Locked (TVL) and represents the variety of digital belongings which might be staked (locked up) in a protocol for a particular interval thus making a secure, safe community in return for rewards. TVL ratios are calculated by multiplying the provision in circulation by the present worth to get market cap after which divide by the general whole issued which determines over/beneath valuation tracked by DeFi Pulse. Token holders carry out self-governance on the community voting on points that want decision. Considered one of these is named “crypto mining”, a course of the place computational energy is used to realize consensus to keep away from double spending. This causes scalability points and utilization charges referred to as “gasoline” that are burdensome. The present course of is a downside to mainstream adoption of DeFi partly due to sluggish velocity and excessive value but in addition for using electrical energy, an antithesis for ESG in monetary providers, which wants speedy correction. Flash loans are utilized by DeFi merchants seeking to revenue from arbitrage alternatives when two markets worth a cryptocurrency in a different way. The mortgage takes place inside a single transaction so the distinction could be collected in nearly actual time. If the lender and borrower don’t observe the principles of engagement the mortgage shouldn’t be issued and the good contract will roll it again because the situation to switch shouldn’t be met, and the cash will likely be returned to the lender. It’s good to register this threat, for if the good contract is breached the mortgage quantity, usually giant, might be misplaced within the course of and this has been a cybersecurity occasion previously.

We’re within the period of disintermediation, of decentralization, not solely of foreign money with cryptocurrencies but in addition of the monetary market, and that is doable by way of an “unstoppable” know-how. DeFi traced most of the providers already supplied by classical finance, but in addition added others that weren’t doable to supply with the previous know-how. Nonetheless, there are main structural and sensible variations. Traditional finance is: a closed system, ruled by establishments, (subsequently) intermediated, reasonably sluggish and costly, bureaucratic, but in addition managed and guarded. The DeFi monetary world is an open system, ruled by the customers and buyers themselves, subsequently disintermediated, quick and low cost, unregulated, unprotected and excessive threat. It needs to be famous that even the previous monetary world, though protected and managed, nonetheless has a excessive diploma of threat if one doesn’t know what one is shopping for or if one blindly depends on intermediaries. Extreme management has by no means totally protected buyers from main scams or losses (i.e. Silvergate Financial institution, Signature Financial institution e Silicon Valley Financial institution). “The mixing of know-how, economics and cryptography, provides the potential of working a totally decentralized, safe and resilient, but in addition publicly accessible, system from which new forms of functions could be realized”(1). On this method, it turns into doable to conceive, perform and shield by way of blockchain (2)advanced monetary actions, and all at minimal value and with out counting on a 3rd get together.

2. Lending and Borrowing.

Some platforms permit holders of cryptocurrencies to lend them to the market in change for curiosity, whereas debtors (lenders) borrow them. Lending exercise within the DeFi world is the most important and already generates large income. Lending and borrowing is likely one of the most necessary ingredient of any monetary system. Most individuals in some unspecified time in the future of their life are uncovered to borrowing, often by taking a scholar mortgage, a automotive mortgage or a mortgage. Historically, lending and borrowing is facilitated by a monetary establishment equivalent to a financial institution or a peer-to-peer lender. In terms of brief time period lending & borrowing, the realm of conventional finance that makes a speciality of it’s known as the cash market. The cash market supplies entry to a number of devices equivalent to CDs (certificates of deposits), Repos (repurchase-agreements), Treasury Payments and others.

Within the cryptocurrency house, lending and borrowing is accessible both by way of DeFi protocols equivalent to Aave or Compound or by CeFi corporations, as an illustration, BlockFi or Celsius. The platform ensures the events as a result of the borrower has to place up collateral to borrow: the most typical exercise is to deposit bitcoin or ethereum and borrow cryptodollars, and often the collateral as collateral is value a minimum of twice what’s borrowed, that is to keep away from the implications of volatility. The preferred lending platforms have fairly excessive deposit volumes, equivalent to Aave.com (with deposit worth of over $12 billion) and Compound.finance (deposit worth of over $6 billion).

CeFi or centralized finance operates in a really comparable technique to how banks function. That is additionally why generally we name these corporations “crypto banks”. BlockFi, for instance, takes custody over deposited belongings and lends them out to both institutional gamers equivalent to market makers or hedge funds or to the opposite customers of their platform. Though the centralized lending mannequin works simply high-quality, it’s inclined to the identical issues as centralized crypto exchanges — primarily dropping buyer deposits by both being hacked or different types of negligence (dangerous loans, insider job and so on.). You may as well argue that the CeFi mannequin mainly goes towards one of many most important worth propositions of cryptocurrencies, self-custody of your belongings. That is additionally the place DeFi lending comes into play.

DeFi lending permits customers to develop into lenders or debtors in a very decentralized and permissionless method whereas sustaining full custody over their cash. DeFi lending is predicated on good contracts that run on open blockchains, predominantly Ethereum. That is additionally why DeFi lending, in distinction to CeFi lending, is accessible to everybody and not using a want of offering your private particulars or trusting another person to carry your funds. Aave and Compound are two most important lending protocols accessible in DeFi. Each of the protocols work by creating cash markets for explicit tokens equivalent to ETH, secure cash like DAI and USDC or different tokens like LINK or wrapped BTC. Customers, who wish to develop into lenders, provide their tokens to a specific cash market and begin receiving curiosity on their tokens in keeping with the present provide APY. The provided tokens are despatched to a sensible contract and develop into accessible for different customers to borrow. In change for the provided tokens, the good contract points different tokens that signify the provided tokens plus curiosity. These tokens are known as cTokens in Compound and aTokens in Aave and they are often redeemed for the underlying tokens.

One other exercise already established within the DeFi panorama is buying and selling on decentralized exchanges (Dex). It’s like buying and selling on the inventory change, however with out opening a place at a financial institution or monetary establishment, you do it on to different customers who present liquidity. The operation of a decentralized change is totally totally different from a buying and selling platform. On a centralized change there’s a person who provides, for instance, bitcoin towards {dollars} (maker) and one other person who accepts the supply and buys bitcoin in change for {dollars} (taker), all of which is regulated by a 3rd get together (change) who ensures that the 2 tons are traded safely, and for this the change takes a fee. In distinction, within the decentralized change there may be one person who acts because the liquidity supplier and the opposite who buys or sells. The person who supplies the liquidity takes a fee.

Every little thing is dealt with by the protocol (platform algorithm, mainly: the appliance) with out intermediaries: the 2 customers change tokens instantly. There isn’t any must know or belief the opposite person; you possibly can belief the algorithm that may concurrently change the 2 tokens. Among the many most generally used Dex within the DeFi panorama are Uniswap.org (with a deposit worth of $7.5 billion), and Pancakeswap.finance (deposit worth of $4.5 billion). On all main DeFi platforms there are not any logins or passwords to recollect, you join together with your pockets, which is often a browser extension. By far the one mostly utilized by a lot of the market is Metamask. A pockets is an utility that manages one’s digital pockets by way of a personal key, an extended password used to activate it. With a pockets you too can transfer cryptocurrencies and Nfts out of your digital deal with to the decentralized platform.

Supply: “Lending and Borrowing in DeFi Defined — Aave, Compound”

3. The Governance (DAO).

Though we’re within the presence of disintermediated protocols and platforms, it’s nonetheless true that somebody has to determine learn how to develop the know-how, what providers to supply, and the way a lot to cost. That is all taken care of by the DAO (Decentralized Autonomous Group) (3), and it’s the entity that governs and decides the way forward for a protocol. It isn’t an organization, it isn’t an affiliation, neither is it a political establishment: it’s the set of governance token holders, and these individuals are nameless. DAOs are growing their potential as a result of they’re simpler to entry than conventional organisations. The members of a DAO are most frequently people who freely pursue a standard purpose and obtain incentives from administration, however they aren’t essentially linked by a proper authorized settlement. DAOs are extraordinarily versatile organisational kinds that may be properly built-in inside extra advanced and conventional realities to mix the benefits of extra conventional authorized buildings with the benefits of decentralised organisations.

DAOs could have members unfold throughout totally different jurisdictions, and this means that at current, within the absence of a regulatory norm, there isn’t a unambiguous authorized framework appropriate for regulating their operations. There are subsequently a number of authorized uncertainties, specifically on the legislation relevant within the occasion of disputes, the legal responsibility of members, the authorized relevance of acts carried out within the absence of human intervention, and the necessity for defense.

Supply: “DeFi and the way forward for Finance”

From a monetary standpoint, DAOs must also present larger reassurance to their members, because the administration of sources (which are usually cryptoassets based mostly on DLTs) takes place in a decentralised kind and no member is legitimised on the outset to maneuver sums of cash to their very own accounts or different initiatives. Furthermore, as talked about above, each transaction is recorded on a public DLTs. In regards to the funding half, DAO don’t make capital will increase and don’t go to VC´s: they create their very own digital foreign money and attempt to persuade, instantly on blockchain, individuals to purchase it. And folks will try this in the event that they assume that DAO will likely be profitable, similar to you do if you determine to put money into a startup or purchase shares in a listed firm.

The governance token is the asset issued by the protocol itself, and those that personal it might vote on the way forward for the mission. The token could be purchased, or one comes into possession of it by utilizing the platform itself by way of AirDrop (reward for a use) or farming (reward for placing money on the platform). There’s a majority vote and every token is one vote.

Normally a token holder (an individual who has possession of a number of tokens) could make any proposal about mission actions, for instance elevating charges, implementing a brand new service, accepting a brand new cryptocurrency, after which the neighborhood votes and decides by majority vote; then the event group has to observe the course. The DAO is thus an nameless and autonomous neighborhood, made up of people that don’t essentially know one another, however all have the identical curiosity within the mission and make selections collectively. The administration of a DAO inside a DeFi mission is about as decentralized because it will get immediately: belief is positioned within the digital code, and within the frequent curiosity in making the system work.

Notes

(1) Mervyn King — The Finish of Alchemy: Cash, Banking, and the Way forward for the World Financial system

(2) A.Lanotte — The affect of AI : Alternatives and Dangers of Synthetic Intelligence in Finance.

(3) A.Lanotte — The DAO: Decentralised Autonomous Organisation.